The Court of Appeals (CA) has denied the motion filed by Marcopper Mining Corp. (Marcopper) asking the court to revisit its decision issued last year that affirmed the order of the Regional Trial Court (RTC) in Marinduque directing the mining firm to pay its realty-tax liabilities based on the 1993 Schedule of Market Values (SMV) as approved by the provincial government.

In a four-page resolution penned by Associate Justice Romeo Barza, the CA’s Special Former Special First Division said it found no merit in the motion for reconsideration filed by Marcopper of its November 28, 2016, resolution and/or new trial.

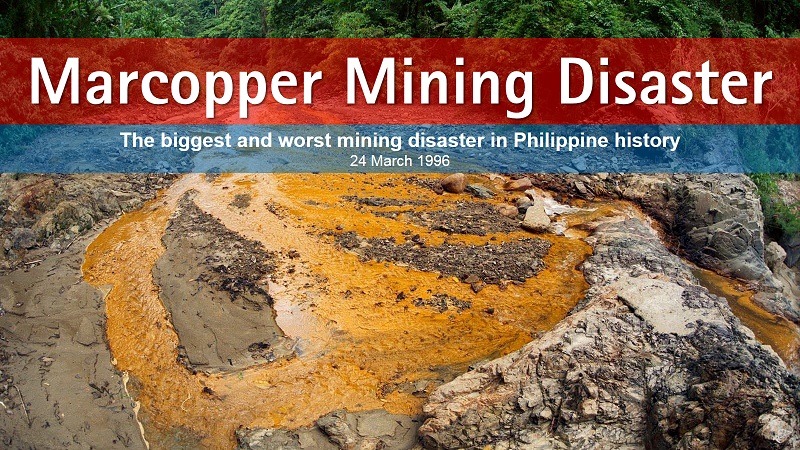

Marcopper is a mining company operating in the province of Marinduque and owns substantial real property in the province devoted to its operations.

The appellate court, in its November 28, 2016, resolution, affirmed its March 31, 2016, decision, which denied Marcopper’s petition questioning the imposition of the 1993 SMV of the Marinduque provincial government.

The CA denied Marcopper’s appeal for its failure to exhaust administrative remedies.

The SMV became the basis of the Marinduque provincial government to issue warrants of levy in 1997 on several real property of Marcopper in the province following its failure to pay is realty-tax obligations.

The implementation of the warrants of levy, however, was enjoined by the RTC in Marinduque, but insisted Marcopper is liable to pay the past and present tax liabilities.

This prompted Marcopper to elevate the matter before the CA.

In seeking the reversal of the lower court’s decision, Marcopper insisted the tax assessment issued by the Marinduque provincial government based on the 1993 SMV was unreasonable, excessive, oppressive and confiscatory.

The petitioner said the principle of exhaustion of administrative remedies is not applicable in the case because what s involved is pure questions of law.

As a ground for a new trial, Marcopper claimed at the October 4, 2016, letter issued by the municipal treasurer showed the realty-tax assessments imposed by respondents was unjust.

Marcopper said it received the letter only on October 14, 2016, during the pendency of the petition before the CA.

The letter, Marcopper said, is crucial evidence, which if duly considered during the pendency of its appeal could have convinced the CA to render a different ruling.

In denying the motion filed by Marcopper, the CA noted the petitioner’s argument on the nonapplicability of exhaustion of administrative remedies, the same was already explained in this Court’s decision dated March 31, 2016, that petitioner should have first filed an administrative protest on the validity of the tax assessment before the Local Board of Assessment Appeals pursuant to Republic Act 7160, or the Local Government Code.

With regard to the motion for new trial, the CA said the letter dated October 4, 2016, could not be considered as crucial evidence and did not constitute sufficient ground for a new trial.

“The letter is merely a demand from the Office of the Municipal Treasurer for petitioner to settle its tax obligations. On its face, it could not prove the claim of petitioner that the tax liabilities being collected from it is unjust, oppressive or confiscatory,” the CA said.

Courtesy of Joel R. San Juan, Business Mirror